GST Impact in Event Planning

Village Carnival

October 9, 2018

Learning To Take Informed Decisions

March 11, 2020Event planning or management, in other words, means organizing, planning, promoting, hosting or conducting all kinds of services. It includes conducting services on conferences, festivals, weddings, ceremonies, concerts, formal parties, conventions, etc. it is all handled and taken care of by the Event Manager.

Who is the Event Manager?

An Event Manager is the one who takes the responsibility of taking care of all the activities and managing the event. He plays the brain of the events being conducted and takes complete responsibility for the events.

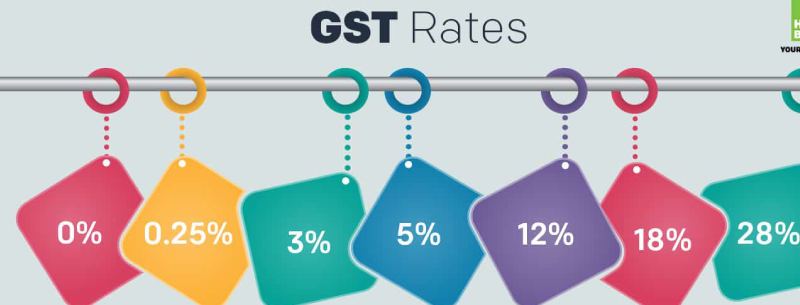

Now take a look at the recent occurrence and activities of the country, the GST has not left even the event management world. The GST rate on the event management and services is levied to 18%, falling under the GST regime.

GST registration applicable for the Event Management Services

Every single person who is related in the event management fields falls under the GST regime. They are entitled to GST if their company falls under any of the following.

- A company or a person whose turnover annually exceeds more than Rs 40 Lakh.

- If an individual resides from the areas of North Eastern like the Arunachal Pradesh, Manipur, Meghalaya, Nagaland, Tripura, Assam, Mizoram, Jammu and Kashmir, Sikkim, Uttarakhand, Himachal Pradesh and the annual turnover of his company is above Rs 10 Lakh in the goods and service tax. Click On – https://www.business-standard.com/article/economy-policy/fm-nirmala-sitharaman-press-conference-live-on-indian-economy-msmes-measures-before-goods-and-services-tax-gst-council-meet-119092000144_1.html

Different types of events have different GST rates

There are so many doubts related to GST in the event management field. Most people are confused as to which category they fall to. The GST has been levied differently on different entertainment events. The details of GST on different types of events are as follows.

GST Rates on the Non-Entertainment Events

- Non-entertainment events include seminars, conferences, training, workshop, trips, and treks belong to the non-entertainment events. They fall under the 18% tax category, as earlier, it was a 15% service tax.

- The ticket price of these events that is less than Rs 250 is exempted from the GST tax. Thankfully good news to people out there.

GST Rates on Entertainment Events

- Access to entertainment events includes amusement parks, cinematograph films, racecourse, go-carting, merry-go-rounds, ballet, sporting events like the IPL, etc would be taxed at a whopping rate of 28%.

- Access to Indian Classical dance, circus, folk dance, drama, theatrical performance will be taxed at 18%.

The implementation of GST is in short a boon for the entertainment industry. It will help the people working in a lower position to a great extent. Now the tickets can be sold directly to the consumers, rather than making rounds to the local entertainment tax department. But to sell online tickets, they must be registered under the GST, even if that means the sale is less than INR 20 Lakh per annum.

Therefore, the GST has brought about relief and difficulties at the same time to different sects of people working in the industry. There are also many help and support being given to the event planning field from the government.